Construction Loans Made Simple

- Apr 9, 2019

- 2 min read

Building your own custom home is a whirlwind of excitement and decisions. One decision that can't be forgotten is how you plan to fund the construction of your home. It can seem a little confusing if you've never built a home before, but we hope this "Construction Loans Made Simple" blog will clarify the process. Take a look at this information from mortgage lending officer, Chris Estave.

Here at High Cotton, we encourage you to find a lender that you know and trust. When you build a custom home and choose to take out a construction loan, it's important to work with both a licensed builder and lender early in the process. Your lender can help you make the best decision about how to pay for the land you plan to build on and also guide you on a total dollar amount with pre-qualification. The spending limit that your lender gives you after you are pre-qualified is an extremely important number to know as you move forward with a builder to decide a budget, floor plan and square footage.

Once you know your total budget amount, you begin working with High Cotton Homes to draw your custom floor plans and make some initial selection decisions. After the plans are finalized, we create your customized, itemized estimate. We take the time to put into your estimate the level of finishes or upgrades that you want in your home; this way, when you take the estimate back to your lender, they have the best idea of what your home will actually cost to build and how it will appraise. At this point, your lender will collect your personal financial information, the plans and our itemized estimate and begin getting your mortgage closed.

During the time it takes to secure your construction loan, we can begin scheduling out your build and getting permits and utilities lined up for your home site. As the build begins and progresses, your lender will distribute the funds to you to pay for the build. Since lenders have different guidelines for distributing the money in the loan, it's important to discuss with your builder the lenders that they have worked well with in the past.

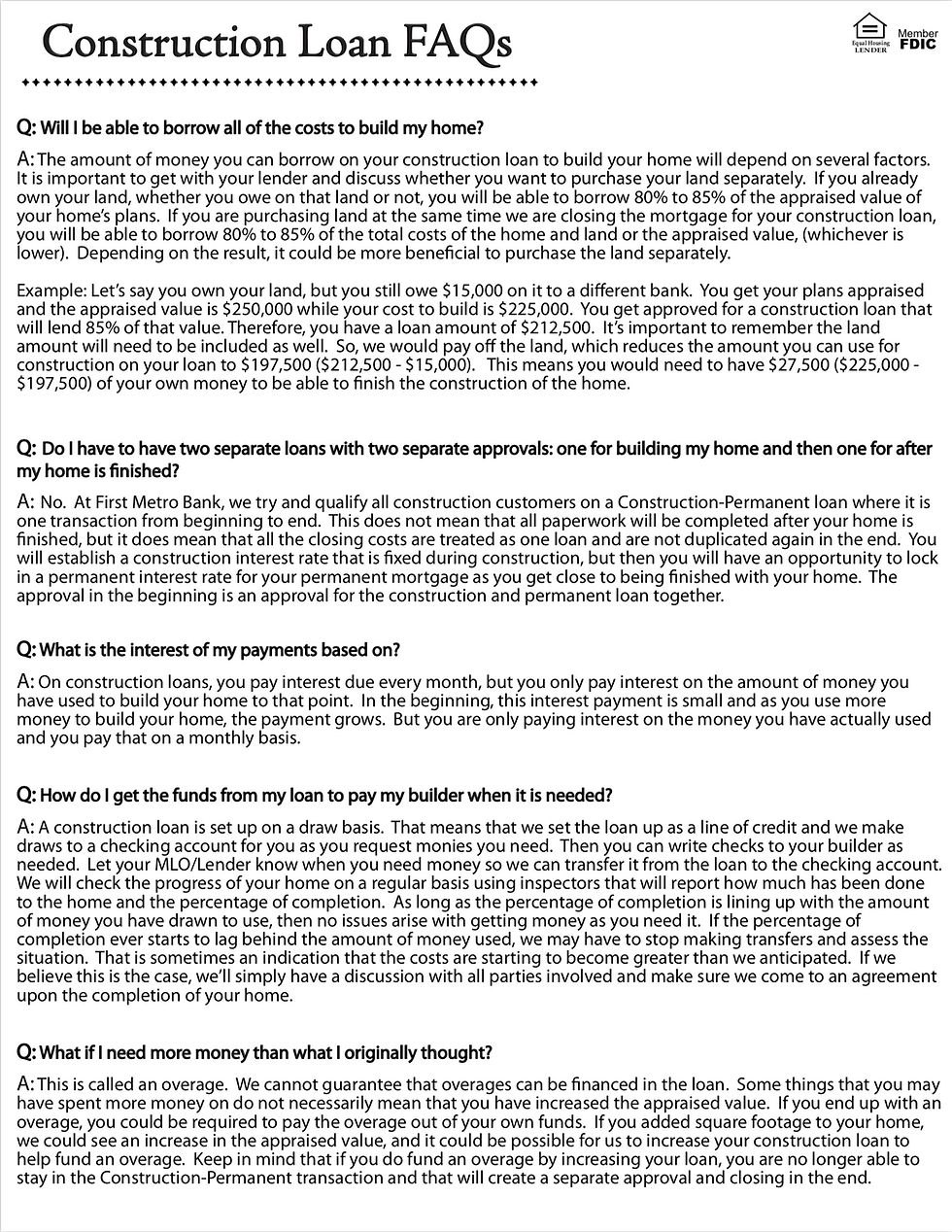

Still wondering more about construction loans? Keep reading these helpful FAQs from Chris.

If you have any more questions, give us a call at (256)281-1626 or contact

Chris Estave, Mortgage Lending Officer First Metro Bank

(256)314-1646

Comments